Knowing Your Place

A primer on Innovation Archetypes in Real Estate Tech

At the risk of redundancy, I keep seeing the same mistakes over and over again in real estate as more people lean in to technology. To be clear, I am very excited about the fact that people are getting jazzed about technology and finding ways to engage. But after working on this for almost a decade, I have seen some mistakes made repeatedly that are easily avoidable.

After discussing the pitfalls of hiring a Director of Innovation, I thought I’d take a step back and encourage some introspection.

Too many people and firms lack the awareness of where there should even classify themselves within the tech ecosystem (most don’t know that a classification exists).

If you haven’t already, please go read Geoffrey Moore’s wonderful tech book Crossing the Chasm. He is one of the pioneers of the Diffusion of Innovation Curve that illustrates how any kind of technology diffuses through an economy. Looks like this:

This model breaks down all humans into 5 archetypes:

The Innovators (2.5% of people)

The Early Adopters (13.5%)

The Early Majority (34%)

The Late Majority (34%)

The Laggards (15%)

Think about iPhones when they were first released.

The Innovators slept outside the Apple Store to get theirs before anyone else. The Early Adopters got theirs soon after. The Early Majority started noticing their “tech friends” with new iPhones and got theirs. The Late Majority saw that everyone else seemed to have an iPhone and they reluctantly got theirs. Laggards still have flip phones.

Why does that matter to PropTech?

Well, PropTech is . . . Tech. Owners and managers of buildings use tech just like consumers use iPhones.

Some have to be the first landlord in their comp set to use facial recognition (Innovators). Some want to be involved right after the first users (Early Adopters), etc.

The problem is that most people don’t know explicitly where they fall and what that means.

Many people will tell you they want to be first in tech and then realize they have no appetite for failed pilots or imperfect technology (which is all technology). That means you’re Early Majority, not an Innovator.

Most people want to think they are innovative. Very few actually have the appetite to be an Innovator (in the mathematical sense). Like estimates of our own driving skills, our perception doesn’t always jive with reality.

And that matters because MANY of the real estate owners, managers, and developers that I know end up wasting a tremendous amount of time trying to be something they are not.

So, I thought I would create a quick guide to how to think about yourself in terms of innovation in real estate.

Let’s move from right to left as that will take us from the simplest solutions to the most complex.

Laggards don’t really care about technology. They are fine with what they have and what they have done. If that’s you, don’t fret. That’s not necessarily bad. You aren’t necessarily wrong, but you should definitely stay away from any and all types of new technology in real estate. They will NEVER impress you enough to get you excited and you will end up wasting a lot of your time.

Sound bite - “If it ain’t broke, don’t fix it.”

What to do = Nothing. You do you and stop reading my posts because they will be useless to you.

Late Majority - If you admit that technology is changing the real estate industry but you have no interest in being on the cutting edge of that, then you are in the Late Majority. That means you will most likely want to wait until it seems like everyone else is using a new technology before you take the plunge.

Sound bite - “Fine. We can get an Argus/CoStar/VTS license if it will make you guys stop bugging me about it.”

What to do = Keep doing what you are doing. Do your deals, play golf, and listen to what your buddies are using in the tech space. Once everyone keeps saying the same name and you can’t go a golf round without hearing about it, head to Google and reach out to the company. No need to go to a bunch of events or learn a bunch about tech. You’ll just get bored/lost and want to get back to deal-making anyway.

Early Majority - If you agree with everything above, but you also want to know about all the tech companies in the space (regardless of whether you engage with them), then you are most likely in the Early Majority. Sometimes called “lurkers” these people tend to want to be in the know on everything that they could be doing and everything their competitors are using. But, but, but they do NOT heavily engage with startups. Knowing about them is good enough. They will wait and see how all this newfangled tech stuff works out and then will pick-and-choose later which ones they want to try. By then the market has beaten any problems out of those companies and they are no longer startups.

Sound bite - “We love learning about and seeing new technologies, but we really can’t afford to have misfires with pilots or technology that doesn’t work seamlessly or flawlessly.”

What to do = Go to events and read some PropTech newsletters. I’ll suggest a few in the future, but the punchline is that you are solving for information flow. Get as many details on startups, how they are used, and what is working as you can. You’ll never see the most cutting edge stuff but you’ll see enough to get the gist.

Early Adopters - Knowledge and awareness aren’t enough. Unapplied knowledge is like unapplied paint to you - useless. You need to get involved with these startups. Run pilots with them. Probably invest in some of them. Maybe invest in several of them. You want to be on the cutting edge of technology . . . but you have a limited budget (time or capital or both). Or you have limited buy-in from the company. Something is holding you back from being on the very bleeding edge of technology, but you are close and you see tons of cool technology.

Caveat - This is where things get interesting and people tend to diverge. Some companies just want to pilot with startups. They say something like “We are just real estate/construction people. We have no business investing in technology companies speculatively.” That tends not to last very long because of the math of venture valuations.

The ones who want to invest capital in these startups (in addition to the pilots they run) have figured out that they can affect a startup’s value.

If we have 3,000 apartment units and we roll out Company X in each of them, that will take their revenue from $200k to $1M in the next year. That will take their value from $5M to $25M JUST FROM OUR PORTFOLIO’S INCOME.”

“Wait a minute! What if we invested in that startup and actually got to see some financial gains from that big pilot we are rolling out!”

Great idea. I’ll write that down.

That’s why you end up having so many CRE firms investing directly in startups. But then things get complicated.

Would you like to invest directly into these startups? If so, how are you going to staff that? What pool of capital will that money come from?

Or, should you just invest in at least one PropTech fund and get the diversification of dozens of investments and use their resources? A mediocre specialist will always outperform an exceptional hobbyist.

Now you have to decide just how deep down the rabbit hole you’d like to go.

Stand up a fund and do direct deals or invest in AT LEAST one other fund to help manage that work and deal load. I say “at least” one because most large firms are best served to invest in multiple funds to cover all the stages and geography they want to cover.

I’ll touch more on this elsewhere, but just know that if you are wrestling with these questions you are in good company. Some of the best CRE and Construction companies in the world are in constant flux around exactly how to play in this space.

What to do = I’ll write a full article about this. So stay tuned.

Innovators - Now for the odd ones. These are the people who are not satisfied with seeing, working with, and investing in the most innovative startups in the world. They see things no one else sees. They have needs and problems that they can’t get addressed in the market. They need to be as proactive about finding and building technology as they are reactive to cool tech that comes across their desk.

Sound bite - “I can’t find a decent startup that does ________. Let’s just build it ourselves.”

What to do = Assuming you are already well-covered with funds and direct investments, find yourself a good venture studio or VC partner that will help you actively build tech solutions in a low-stakes setting. These partnerships will not replace your CTO (because we both know you’ve had a great one for years). They are here to support and build while she is busy on more near-term internal projects. Give the VCs/builders the moonshots and fringe cases. They’ll sort it out.

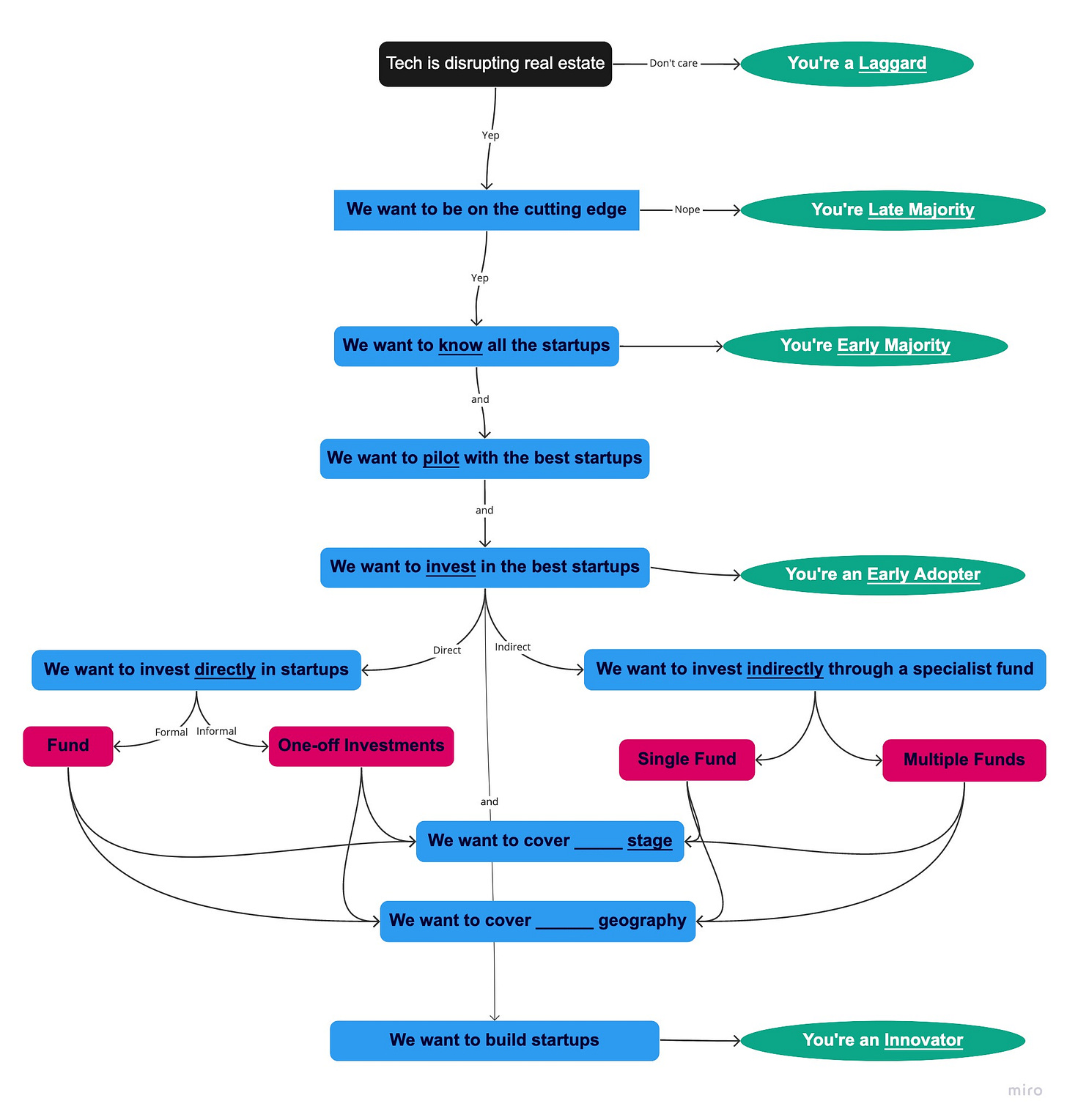

I created a visualization of this decision flow that you can see here.

This is what it looks like:

The basic use of this flow is to read the question and then see how you (or your firm) would answer it. That should tell you where you fit within the ecosystem.

For example, if you read the first statement (“Tech is disrupting real estate”) and your first reaction is to be apathetic, that means you are a tech laggard. Which, again, isn’t necessarily bad. It just means that tech isn’t your thing and you’ll never have an advantage based on technology. That’s fine. Why are you reading my PropTech articles?

A couple caveats before I let you go.

First, I want to acknowledge that these archetypes apply to both people and firms. You can be an Innovator inside an Early Majority firm (but I bet you get frustrated and leave eventually).

Second, there is certainly some fluidity between these archetypes. Some people have woken up to see that tech is driving returns for their competitors and they vow never to be that late to the party again. They move from Late Majority to Early Majority. I myself vacillate between Early Adopter and Innovator but am (perhaps surprisingly) most often in the Early Adopter camp.

Having said all that, this framework is important. You need to know where you fit in the ecosystem to know when and how to engage with technology companies.

If you don’t you are more-or-less just stumbling around reacting to whatever tech or problems happen across your desk. Take my advice and be intentional about this. It will save you and your firm years of time and untold amounts of money of avoidable false-starts.