Venture Capital has been on a nice run lately.

In the last ten years, the venture capital (“VC”) landscape has grown exponentially as companies like Paypal, Facebook, Google, Microsoft, and others have sent their alumni into the world with pockets full of cash and heads full of innovative companies.

Poke around Crunchbase or Pitchbook or any major publication that covers technology and you’ll see a cornucopia of “Ex-Googlers” and the “Paypal Mafia” starting some of the coolest companies in the world and their buddies at venture capital firms pouring cash in.

When that level of wealth and value-creation happens, people notice. Even old-school, stolid industries start thinking about startups. They start to ask “How do we get in on this” or “How do we make sure we are not the next Blockbuster to someone’s Netflix or Marriott to someone’s AirBnB?”

Inevitably, these huge firms form venture arms to invest in these startups because the math is easy. If you have $500M in liquidity on your balance sheet, $50M for a small internal fund to hedge against becoming the next Blockbuster is a pretty safe move for a CxO.

The problem is, I keep seeing the same mistakes being made over and over again by the Corporate Venture Capitalists (“CVCs”). I’ve touched on a few of them before, but I want to address a specific one today that keeps popping up.

CVCs and Stage Fit

If you are unfamiliar, you should know that startups come in stages. A 1-year-old seed stage AirBnB is very different than a 9-year-old Series F AirBnB. As a corporation (say Marriott), you have three things you can do about or with startups:

Know about them (“They are coming for us so we need to watch them.”)

Partner/Pilot with them (“They are accretive to what we do every day and we should find a way to partner with them.”)

Buy them (“These guys are a fly in our ointment or extremely talented and valuable/complementary to us. We need to acquire them, their team, or intellectual property.”)

To vastly oversimplify this, most corporates have trouble engaging with companies before they have raised an A Round. I’ll get in to the math in a minute, but, definitionally, most companies that are earlier than A rounds (i.e. Pre-Seed and Seed) are still figuring out their business model, working on integrations, tweaking pricing, etc.

So, you can imagine a multi-billion dollar Marriott saying it would be challenging to work with an AirBnB when Brian, Joe, and Nate had only a few thousand dollars in revenue, no experience with commercial hospitality, no integrations with property management systems, reservation management system, channel managers, etc. AirBnB couldn’t afford to build those integrations while they were walking around New York taking photos of their listings or making cereal boxes for the DNC.

That ignores the added complication that Marriott would have getting AirBnB through Vendor Compliance, Legal, Branding/Marketing, the CTO’s tech stack, the operations team’s workflow, and a half dozen other teams who would want their input heard if Marriott were to run a pilot with AirBnB (in some hypothetical alternate history).

It would take months and probably quarters/years.

And the additional functionality and integrations that AirBnB would need to build with a skeleton tech crew would be in the tens or hundreds of thousands of dollars.

Would that be a wise use of resources for a company with a few thousand dollars of revenue and almost no cash reserves?

Can you see why large companies have trouble working with Seed stage startups?

Until they have meaningful revenue to justify the additional integrations and features, most startups generally can’t afford to play with big corporations.

I’ll make it even more stark with some numbers . . .

PropTech Data - Fun with Numbers!

In my world of PropTech, I cover between 4,000 and 6,000 startups. That’s JUST in the United States and JUST companies that focus on COMMERCIAL real estate. I don’t cover residential well yet and my international databases aren’t reliable yet.

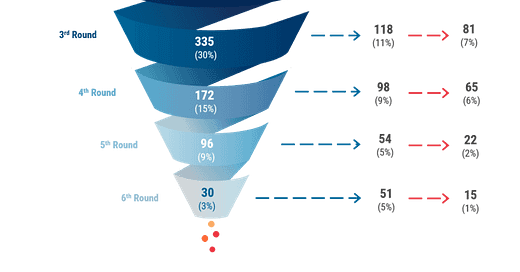

For simple math, let’s say it’s an even 5,000 companies. And let’s assume that 75% of those companies are Pre-Seed and Seed. That’s probably low given the attrition rate of companies that end up raising an A round. See this image from CBInsights:

Still, it’s close enough.

That means that in PropTech alone, there are 3,750 seed stage startups to track.

To further narrow it, let’s assume you are Marriott and only about 1/3rd of those companies can actually be useful or relevant to hotels and hospitality. That leaves you with 1,250 companies to cover.

That’s not so bad, right?

Well, if you read what I wrote above or if you have worked with a startup ever, you know how dynamic they are. Every startup is working on what they offer, how much they charge, who they integrate with, etc. These are moving targets. They do not stay still. Knowing what a startup does in June does not mean you know them well in December.

If you want to deeply understand the startups in your space, you need regular contact with them. Ideally, twice a year. If you assume 25 work weeks in a half year and 9-hour work days, you have 1,125 work hours. Let’s assume you are efficient with your time and only need 30 minutes with each startup. That would be 625 hours of Zoom calls (who has time to meet in person?) every half-year. That’s 25 hours per week of just meeting with Seed stage startups. 5 hours every single work day.

That might be doable.

Unless, of course, you have existing pilots to run. And you have diligence to do on startups you want to run pilots with. Using CBInsights math above, you have 600 companies that have raised an A round (48% of 1,250) that need your full attention because they are pilot ready. And you have internal battles to convince your ops and tech team they actually need to use new software. And you have to yell at your company’s General Counsel for trying to force software vendors to carry $10M of liability insurance for a SaaS product. And you want to do pesky things like answer emails or eat lunch. Or have internal meetings of any kind. Oh, and you don’t know which 33% of those 3,750 companies are actually relevant to Marriott until you review their product or speak to them.

Totally doable, right?

I’m being tongue-in-cheek about this but do you see how this is an impossible task?

No Director of Innovation, CTO, or Director of Sustainability has a chance of actually keeping up with these Seed stage companies. There are too many and they are too fluid.

So, what ends up happening is that CVCs just start paying attention when a company is mature enough to raise an A round.

The problem with that is that a) at that point, everyone with an ounce of innovation knows about the company and any strategic advantage you could gain from using them early is gone and b) their product is fully “baked” and you can’t get special integrations, pricing discounts, etc.

Plus, if you are Marriott, don’t you wish you could at least know about and closely follow AirBnB when they were just a lowly Seed stage company? Don’t you think they wish they could go back to when AirBnB was a $10M company and offer to buy them? Or $50M? or $500M?

So, how does a CVC engage at the Seed stage without overtaxing and burning out their team?

My answer is self-serving so I’ll keep it brief but there is only one way I have seen be effective - Invest in an external fund.

Find a fund and partner that you can trust to understand your interests and pain points and let them handle your “top of funnel.” If you can, negotiate co-investment rights that allow you to invest in AirBnB when it comes along. That’s a much more effective use of your time than trying to manage thousands of startups every year with a handful of over-worked and under-staffed innovation and tech employees (more on that in another piece).

As I said, this is totally a self-serving argument because I invest at the Seed stage on behalf of large CRE and construction firms.

But . . . tell me where my logic is off.

You don’t have to invest with me (I’ll make some referrals, if you are interested), but you do need find a partner you trust to manage the top of your funnel. Otherwise, you are trying to drink the ocean and your innovation team is just going to drown.