Construction Labor Technology

Plus 3 Fundings, 7 Pieces of News, 6 Worthwhile Articles, and a Video to Watch.

Has anyone else noticed the recent explosion in construction labor startups?

YC alone just announced the graduation of Toolbox and Ladder for construction labor.

I’ve been tracking Hammr for a couple years and met TradeHounds earlier this year.

Then I saw that Core got a funding round from NfX in the last couple of weeks (which probably makes them a serious player).

That’s 5 interesting startups with decent traction going after the same problem - the supply of labor in construction.

We can talk about competitive dynamics in crowded markets later and I don’t want to do a full analysis here.

But I do want to pose a question - Are these guys solving the right problem?

Everyone seems to agree that there is a problem finding skilled labor for trades and subcontractors in construction. It’s not highly controversial.

But I did have an interesting conversation this week with a member of my angel group who runs a large regional GC and his thought was that the process isn’t the problem. The quantity of supply is the problem.

Said another way, no matter how beautiful and streamlined the finding/hiring/onboarding process is for these workers, there simply aren’t enough human beings filling these jobs.

In his eyes, the process and tools aren’t the problem. The industry’s inability to attract young people was the problem.

Let’s dig in a little more next week.

On to this week’s deals and data:

Fundings:

Coliving startup Common raised a $50M Series D led by Kinnevik. You can read Brad’s comments on it here.

Turntide Technologies, an electric motor startup focused (at least partly) on buildings, raised $33M from several investors including JLL Spark.

Core, a construction labor marketplace, raised $4m from NfX and others.

Funds:

Paid Subscribers Only

News:

Interesting. Looks like Latch is on a collision course with SmartRent.

Regus joined the list of coworking operators closing or going bankrupt at certain locations.

It’s technically PropTech, but I’m not sure how I feel about this.

Truss has been acquired (sort of) by Avison Young.

AirBnB listings fell for the first time this Summer but spending is way up. Not sure how this affects the IPO . . .

That massive flight to the suburbs everyone predicted . . . hasn’t quite happened.

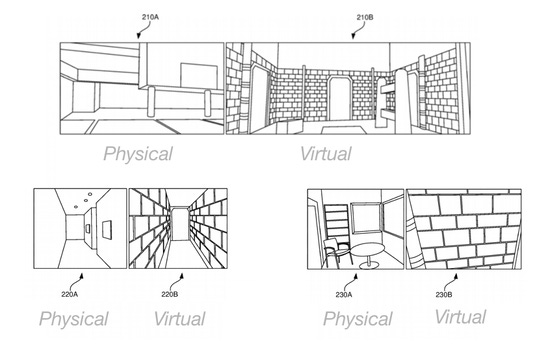

Microsoft filed a new patent related to spacial mapping for VR. See the image below. Interesting implications for indoor spaces in CRE but time will tell how Microsoft handles the enterprise sales aspect of the tech.

Articles:

Chinese PropTech is about to soar.

CNN has a piece on the post-COVID reality for WeWork.

Office landlords think you’re coming back and some bosses are getting “creative” to get you back.

The new normal was already coming in PropTech.

How is Google getting completely carbon-free energy by 2030?

Watch:

Blueprint has a video interview with Alex Samoylovich of Livly.

One Last Thing:

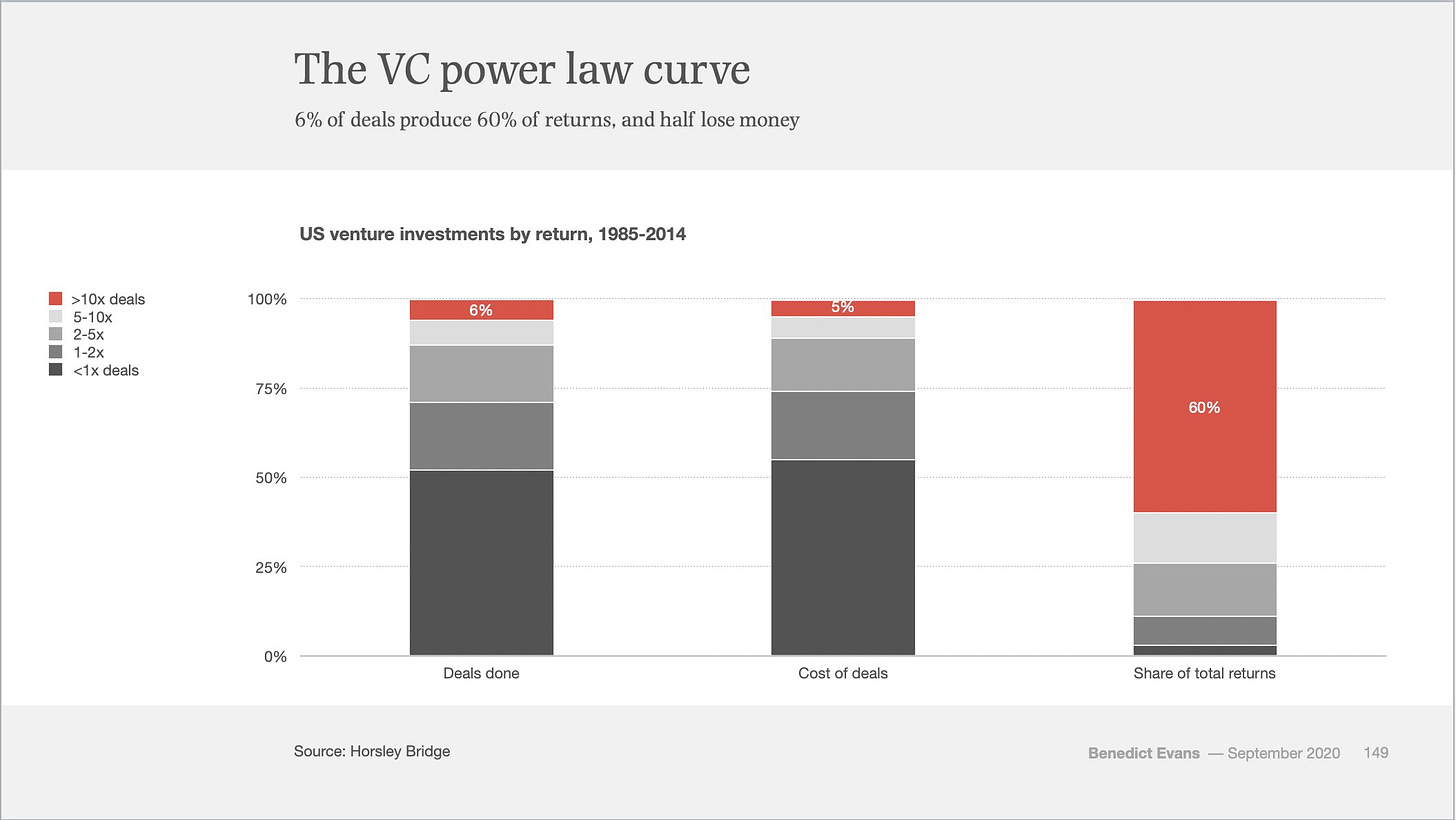

I don’t care if this is precisely correct because it is directionally accurate and most people coming from CRE miss the math here:

Our next subscribers-only virtual happy hour will be Friday October 16th at 7 EST/4 PT. If you want to join, become a paid subscriber and I’ll get you on the invitation!

If you learned something from this newsletter, please send it to a friend. If not, send it to someone you hate and help me clog their inbox.

If you have any financings, articles, or suggestions for me, please reply to this newsletter and tell me what’s shaking.